Earn more without quitting your job or starting a business

Plus an EXACT breakdown of how to invest

In this week’s issue of FHG, we’re going to be talking about increase our earning potential, improve our financial well-being and work life balance without quitting your job or starting a side hustle. We’re also tackling a community AMA all about stocks and shares ISAs!

Improve your financial well-being? Without quitting? The answer is weirdly simple

As a FHG, we’ve nailed our expenses and we want to increase our income. But how do you actually do that? Some options are starting a business, picking up an extra job (tutoring, dog-sitting) or negotiating higher pay rises. But the option most of us overlook is increasing our earning potential.

One way to increase our earning potential is to apply an entrepreneurial mindset to everything you do. And here is exactly how to do it, with 7 actionable steps you can apply today.

1. Embrace innovation: start with your desk 🪑

Take a look at your current way of doing things and think about how you could innovate it: make it better for you and everyone around you.

Actionable step: identify one process in your daily workflow that can be streamlined. Propose your ideas to your team or manager and collaborate to implement the improvements.

2. Be a problem-solver: tackle challenges head-on 💡

It’s great to identify challenges at work, but how can we actually take them on and learn from them?

Actionable step: when faced with a work-related problem, use the “5 Whys” technique. Ask “why” five times to get to the root cause, and brainstorm potential solutions.

3. Network strategically: cultivate connections 🤝

Simon Sinek once said that human connection should be part of Maslow’s hierarchy of needs.

Entrepreneurs never have all the answers, or pretend do. As humans, we need to ask for help from time to time—and provide that help to others. Part of this is building a support system around you to be able to do this.

Actionable step: commit to reaching out to at least one person in your field of interest each week for a coffee chat or virtual catch-up. Build genuine relationships that extend beyond your immediate team.

4. Stay hungry for learning: set a brain growth plan 📚

This one is simple: never stop learning. As Ali Abdaal (our learning king) said;

Learning how to learn is one of those meta skills that nobody ever really teaches us. But, it’s also the number one skill we should learn if we’re looking to significantly improve our life in basically every single way.

Actionable step: Identify one skill or knowledge gap you want to fill in the next three months. Enrol in an online course or workshop to expand your expertise. Make sure you’re making progress to closing this gap every week for the next three months.

5. Own your career path: create a career Map 🌐

You know what they say about a goal without a plan? It’s just a wish.

Actionable step: outline your career goals for the next year and break them down into actionable steps. Importantly: share this plan with your leader during your next performance review.

6. Fail Forward: learn and adapt 🙌

Failure is such an important part of life—not only is it character building, but it teaches us the lessons that we need the most. If we want to increase our earning potential, we need to know how to fail, so that we know how to get back up.

Actionable step: start a “Failure Journal.” Whenever you encounter a setback, jot down the lessons learned and actionable steps you can take to avoid similar situations in the future.

7. Cultivate resilience: build a resilience toolkit 🌱

As part of failing forward, we need resilience to be able to get back up even faster than we fell. Resilience is an unbeatable quality to have if you want to truly add value wherever you work: business is always volatile and adaptation is needed at every level.

Actionable step: create a list of activities that help you recharge and stay positive, like exercise, meditation, or hobbies. Make time for at least one of these activities every day—it doesn’t matter how small the activity is, or how busy you are. Committing to one of these per day is a non-negotiable.

Community AMA

Rav asked: Stocks and shares! I have a stocks and share ISA but if I’m honest I don’t really know what I’m doing with it. Some clarity would be amazing! As a non maths/finance girl I can very easily confused lol

Amazing that you already have a stocks and shares ISA! An ISA allows you to invest up to £20,000 (across any and all ISAs you have opened) tax free. This means any gains you make from compound interest in the ISA are tax free ✨

Depending on who you have your ISA with, you can invest in...

index funds

individual stocks and shares

bonds

...and more, but you can Google that!

To pick what to invest, I personally looked at my risk tolerance (I didn’t want to invest in anything too risky) and the time I had spare to research anything (I had very little time).

Investing in individual stocks and shares: slightly more risky, as you’d be putting all your ‘eggs’ in one basket (the company whose share you’d buy).

It’s also more time consuming as you have to research the company you want to invest in: do a little analysis on their financials, know what it is you’re reading, find out who runs the company (Girls That Invest talk about this a lot in this episode!)

Investing in index funds: slightly less risky, as you’d be putting your eggs across a few companies. It’s also less time consuming as the fund is tracking the index, rather than you researching all these companies you’re investing in.

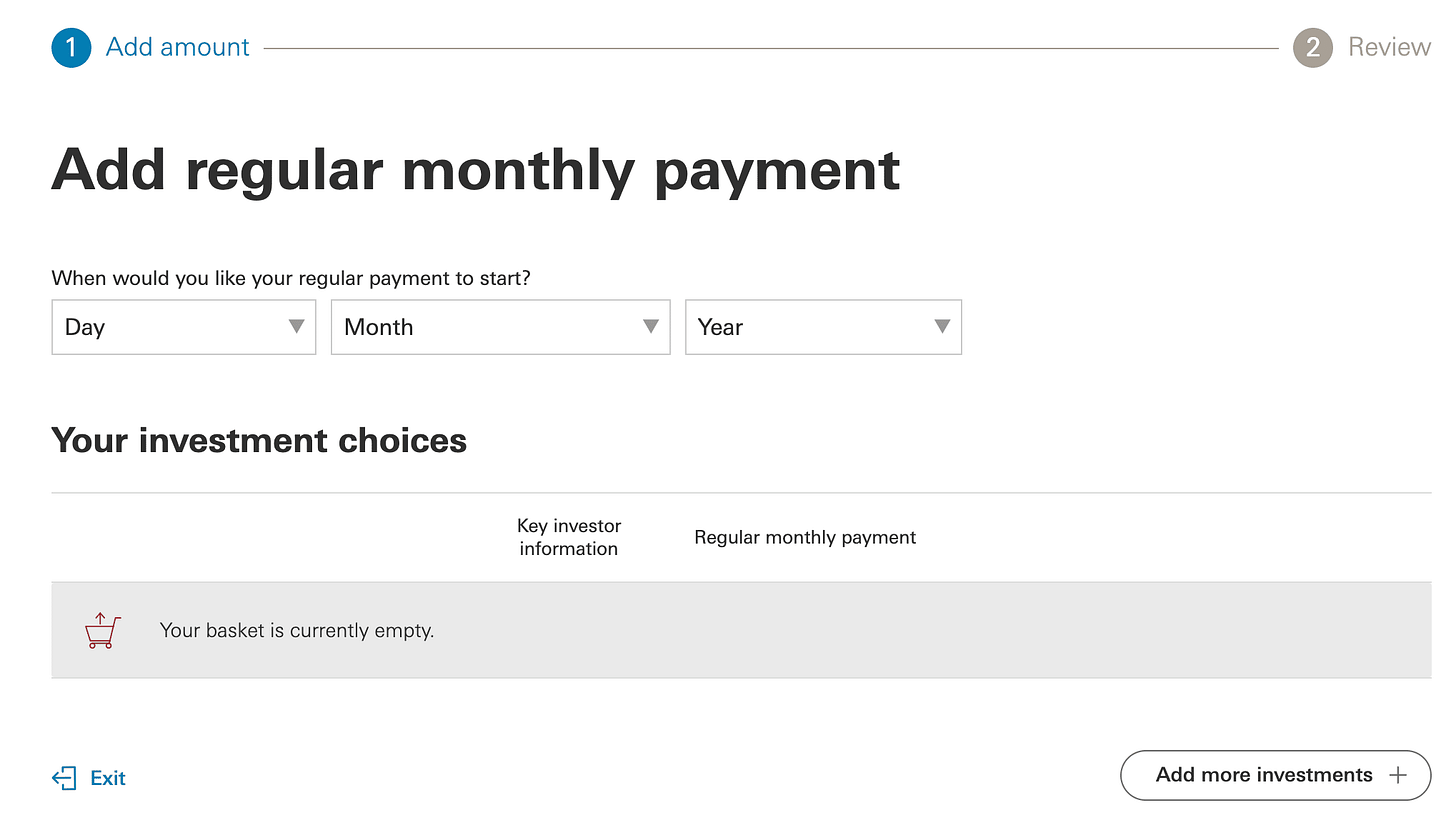

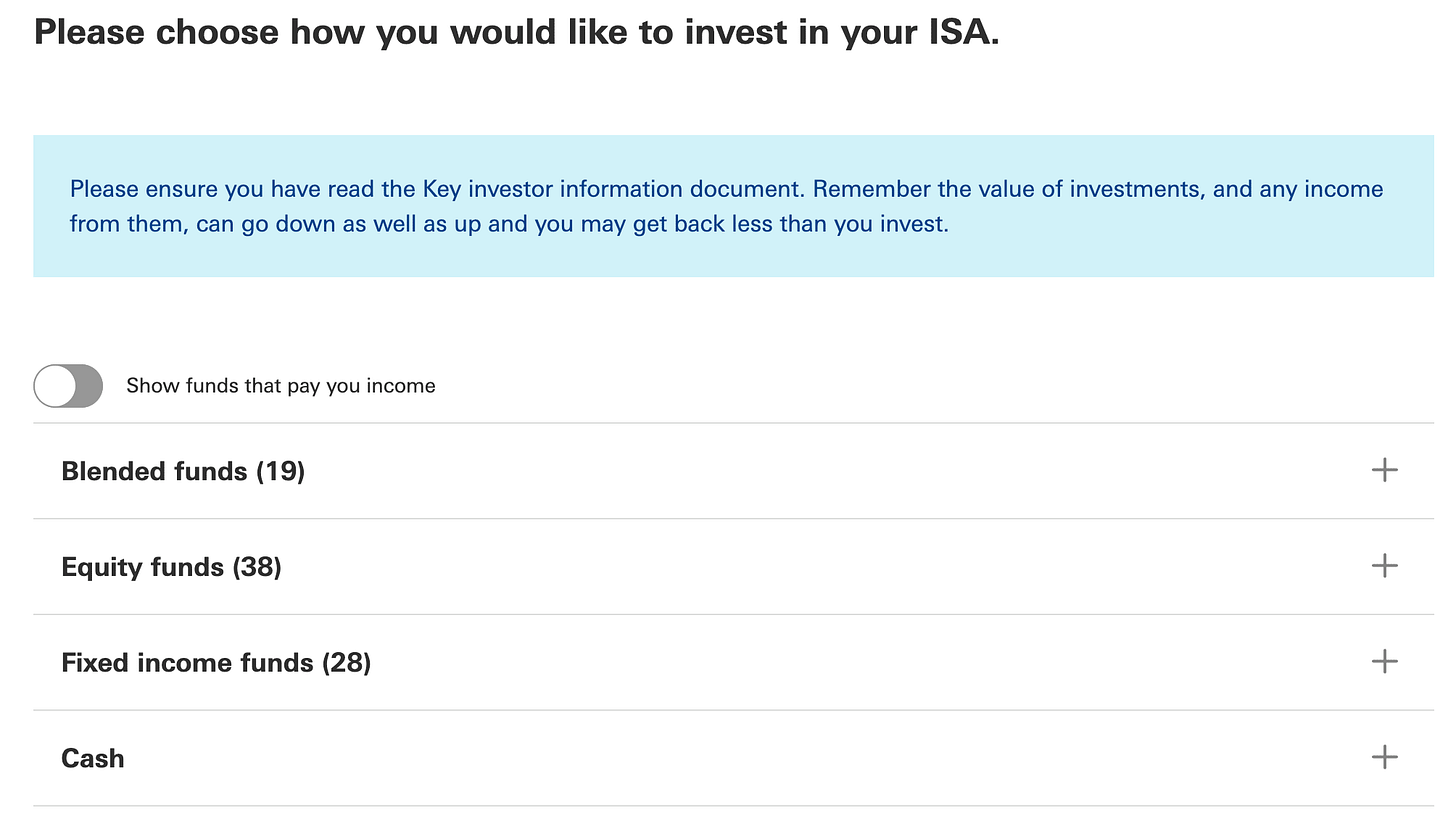

I use Vanguard to invest in index funds—in the FTSE Global All Cap Index Fund Accumulation fund. In Vanguard, you can set up a payment where you can set the date, amount and investment you want to make:

Once I set a payment up, I leave it alone until I decide to increase it. The leaving it alone bit is what builds up your investment and compound interest over time!

It’s as simple as that—you can add more payments for any other investments you want to make, but I’ve kept it simple with one monthly recurring payment of at least 10% of my salary going into the FTSE Global All Cap Index Fund Accumulation fund.