the discipline that you rely on is expiring

why what worked before stops working next, and what exactly to do about it | fhg #72

2025 has been my first whole year as a solopreneur.

And even though it’s been a year of working for myself, I’m still behaving like I’m in the early stages of balancing this with a corporate job.

I’m still relying on the same grit, pressure, and self-control that helped me leave that job in the first place.

And the problem is, the results are not coming like they used to. Working harder just makes me…more tired, less motivated, and less inspired.

There are two truths here I’ve avoided thinking about:

The same discipline that got me to the point of quitting corporate is not the same discipline that will allow me to evolve as an entrepreneur.

My attachment to discipline is no longer a strength. It’s most definitely a psychological safety blanket.

And I know for a fact I’m not alone in thinking this. Like many of you reading that dream big—we over-identify with discipline because it got us the early rewards. Whether that was a big financial milestone, promotion, or something else that defined our success.

So when things feel harder, we tend to hold on tighter—it’s the only thing we’ve proven that works.

But if we don’t course correct before 2026, the same discipline that moved us forward will be the very thing that constrains us.

“What got you here, won’t get you there.”

- Marshall Goldsmith

The trap of early-stage discipline

Charlie Munger said that the discipline required to reach your first 100k in net-worth is not the same discipline required to reach 1 million. This is a financial concept, but it applies across all areas of life.

Early progress (with most ambitious goals) rewards grit, restraint and stern boundaries. But later progress rewards judgement, leverage and selective risk.

The mistake that you and I make is clinging to the early rules out of loyalty, pride, or fear of losing control. But maturity with money (and life) means knowing when to keep the lesson, and retire the behaviour.

For example: a lesson you keep might be living below your means to get ahead of your finances, but the behaviour you retire is staying in permanent underconsumption.

Being mature with money is taking the lesson and spending intentionally on things that expand your earning power, time or wellbeing.

But the reason we cling onto that early discipline is that we’re often trying to combat a dysregulated nervous system that’s fuelling our inability to take action. We don’t feel safe changing the behaviour that got us here.

What actually gets you there (into 2026)

Hopefully by now you know that it’s not more discipline that will unlock our growth.

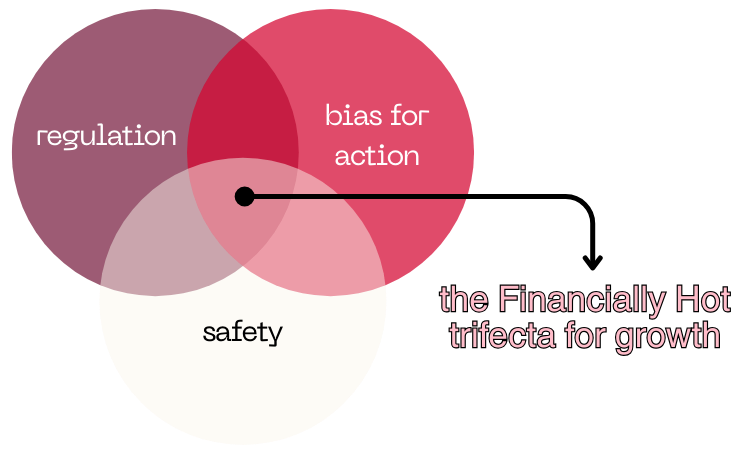

The next phase of your finances, business, career or life is freed by regulation, safety and bias for action. The Financially Hot growth trifecta.

Specifically:

Nervous system regulation: so your body isn’t constantly interpreting levelling up as a physiological threat

Psychological safety: so you don’t freeze when outcomes aren’t guaranteed

A habit of sloppy action: so you stop waiting for certainty before moving forward

Because realistically, you can read as much business, money and life advice as you want. But if you never feel safe enough to actually act on it, nothing happens. A truth we all know, and didn’t have to confront during the early stages when discipline carried us.

But understandably, for a lot of us more ambitious and high-agency types, a failure to act is a fear of uncertainty. It can literally feel dangerous.

Most of us develop a need for certainty via a nervous system pattern early in life. Growing up with financial instability, emotionally unpredictable caregivers, or a pressure to be responsible early which looks like over-thinking, procrastinating and a need for control, and certainty, in adulthood.

You essentially need your body to believe it’s safe to move forward without knowing exactly how things will unfold, even if you know it’s safe intellectually.

Prompts to make real progress despite this setback

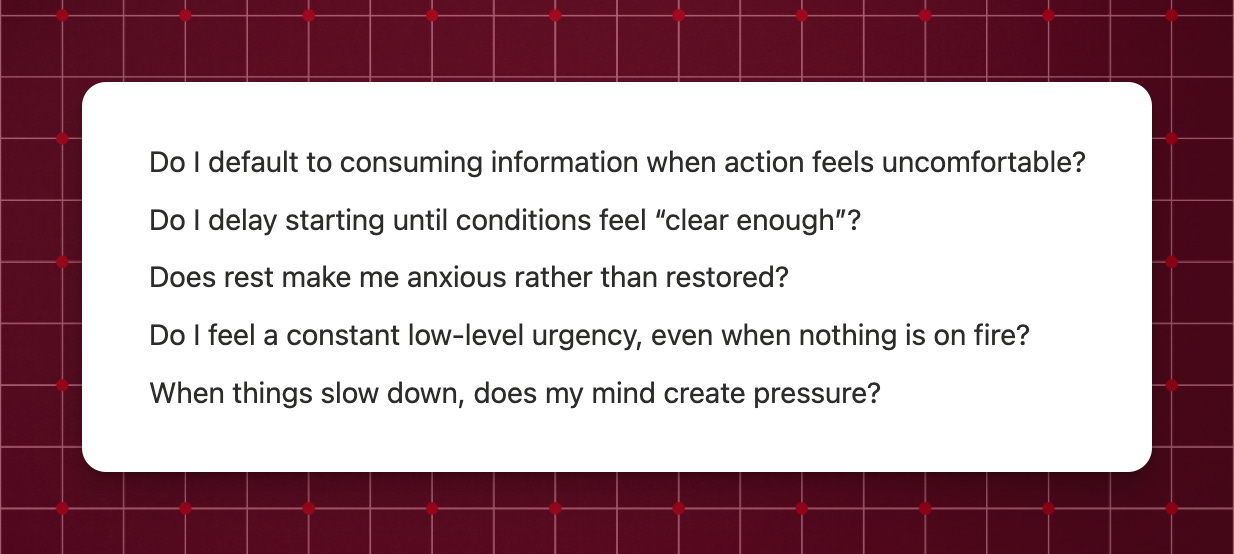

Remember financial hotties, these are not questions to examine your personality and find anything ‘wrong’ with it.

They’re a way to collect data so you can make better decisions about your life and money.

Answer these honestly, and without judgement:

If you’re answer yes to a lot of them, it means your nervous system likely learned that discipline = safety at an early stage. And this internal rule hasn’t been updated yet.

How to change your internal rules before 2026

First, audit what rules you are silently living by. Across your mindset, physical wellbeing and finances—what happens automatically despite not being optimal anymore?

Some common mental rules that used to be optimal but aren’t anymore:

Adding more tasks instead of stopping to question whether the tasks matter

Skipping recovery, reflection, or planning because it feels indulgent

Over-researching decisions that have low downside

Feeling uneasy when things are going well but not tightly managed

Believing delegation is something you earn later

If you’re moving into a growth or expansion phase, your rules need to change based on these 3 main drivers.

Psychological safety over urgency

Read: The Body Keeps the Score (foundational for understanding why urgency lives in the body, not the mind)

Do somatic work: breath-work, slow strength training, walking without stimulation

Consistency over intensity

Read: Atomic Habits (for reinforcing identity through small wins) & The Mountain Is You (especially useful for high-functioning self-sabotage patterns)

Set daily minimums: non-negotiable “bare minimum” standards

Action over optimisation

Read: The War of Art (reframes resistance without over-psychologising it)

Use time-boxing tools (25–45 min focus blocks, then stop)

Do things publicly before you feel ready (on something with small stakes, but with frequent reps, maybe like posting content, investing a tiny amount or starting a movement habit)

These 3 things help create momentum once discipline and effort have reached their ceiling.

So there we are, financial hotties. What got you here did its job, and for that we remain grateful and graceful.

But now it’s your turn to decide what gets to come with you, and take action on it.

So ask yourself:

“Which rule helped me survive 2025, but is now stopping me from progressing?”

Here’s to not being your own bottleneck in 2026.

Until next week,

—Dev xo

Appreciating the level of depth into the human condition + complimenting how you translate the experience in a way we can understand. Grazie.