your A/W financial curriculum

new resources and mini-tutorials now live! | fhg #56

Your Autumn curriculum for getting financially, mentally, and physically hot has just landed.

September starts on a Monday (tomorrow!). November ends on a Sunday.

The timing couldn’t be better. We have a clean 12-week runway to reset, build discipline, and level up before the year closes.

This is your chance to treat your next three months like a syllabus. Importantly, not using it for random motivation, or half-done habits, but a structured plan with an outcome. Learning and financial literacy is important for the rest of your life.

P.S. the concept of having personal or subject specific curriculums was popularised by the ultimate cool girl TikToker Elizabeth Jean, who is such a financial hot girl in our eyes. She regularly posts her monthly curriculums and updates so you can stay consistent. Check her out for more curriculum inspiration.

𝜗ৎ In this issue:

Step One: Decide Your Outcome

Before you dive into the reading lists and experiments, get clear:

What’s the result you want to walk away with by December?

Do you want to feel financially calmer? Build discipline? Understand investing properly?

Write it down. Research in behavioural psychology shows that specific, outcome-led goals are 42% more likely to be achieved when written down.

This syllabus only works if it directs your effort towards a finish line. Learning isn’t just a trend!

Step Two: Build The Discipline

The FHG 12-week curriculum isn’t complicated, but it does require discipline.

Here’s why:

Consistency beats intensity. Reading 20 pages four nights a week matters more than bingeing 200 pages once.

Systems create freedom. The weekly structure I explain below (reading → experiment → project → reflection) means you don’t waste energy deciding what to do each day.

Identity shift. Each small action is a vote for the person you’re becoming. Someone who takes money, health, and learning seriously. Someone Financially Hot.

James Clear calls this the “compounding effect of habits.” The discipline is about creating momentum in your life that will level you up in other areas that you can’t even predict right now.

For example, my writing habit from the 100 day challenge exactly this time last year led to the rebirth of Financial Hot Girl.

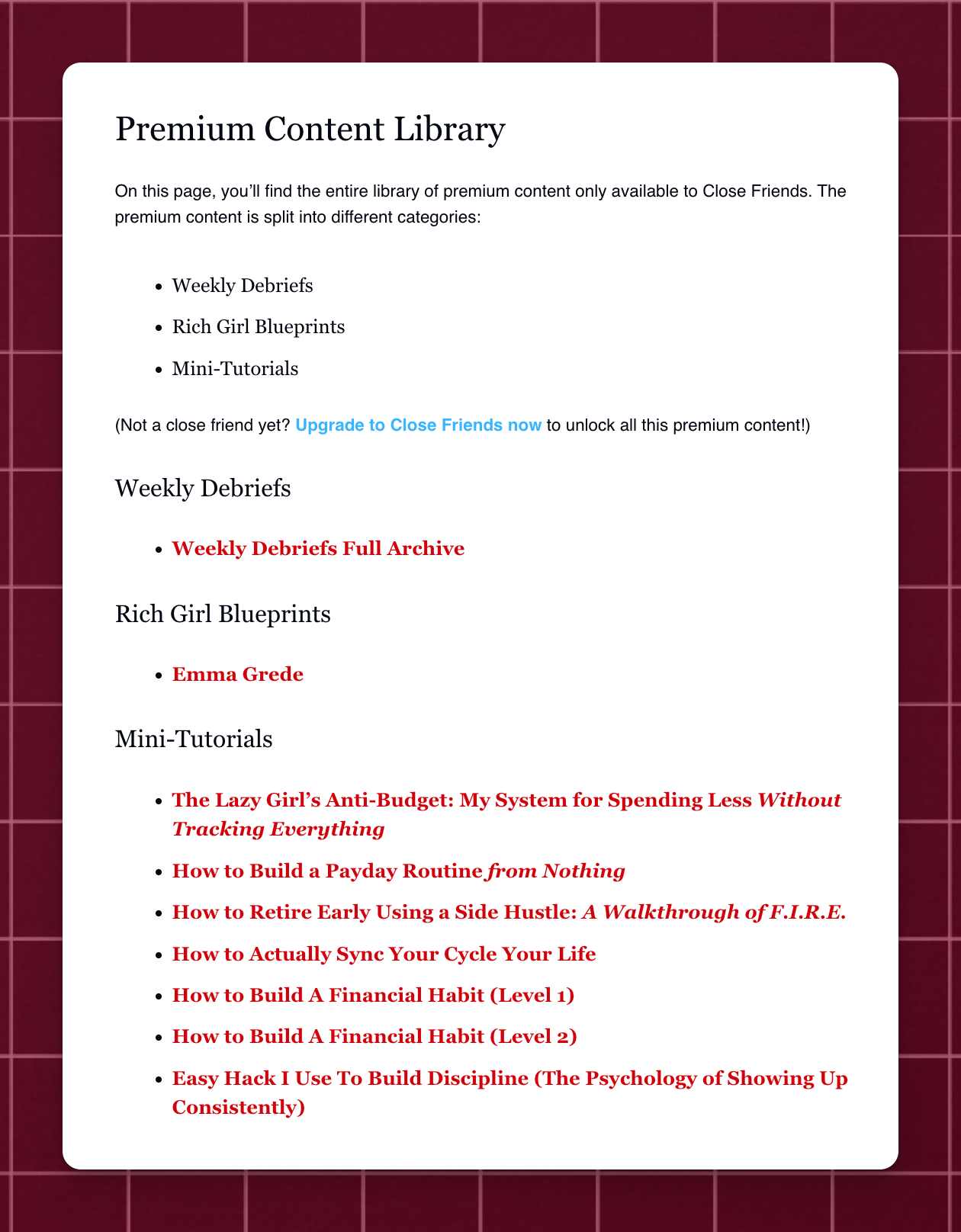

Discipline also doesn’t have to be something you build by white-knuckling your new learning habit. Implement a system to make it easy for yourself, like I’ve explained in this mini tutorial: Easy Hack To Build Discipline Easily.

Step Three: Understand the Psychology of Getting Smarter

Being Financially Hot isn’t just about money (the haters call us obsessed 😉). It’s about becoming sharper, wiser, and harder to shake. Cognitive psychology actually gives us tools for this:

Spaced repetition: Reviewing notes at intervals (1 day, 3 days, 1 week, 1 month) cements them in your brain way better than cramming.

Active recall: Closing the book and testing yourself strengthens memory and understanding.

Teaching effect: Explaining a concept out loud (even to voice notes) forces clarity and shows where the gaps are. I do this all the time with content!

Elaboration: Linking new knowledge to your own life (money habits, fitness, career) makes it stick. Your brain remembers stories way more than facts, so create your own.

This is how you don’t just consume content, but change your brain. The more you train your memory and clarity, the more valuable you become in work, business, and life.

Remember that learning permanently expands your brain. You level up from choosing to learn over just going through the motions of life.

Your Autumn Curriculum

I’ve put this together based on what I know about my own personal finance journey and the steps I wish I took seriously first. Therefore, this syllabus takes you from understanding your own body, mindset and habits - then to weaving in elements of financial literacy in a way that makes sense.

September: Habits & Systems

(Reset your habits and get clarity)

Experiment: Run a 7-day spending diary — track every pound, no judgement

Project: Open a savings account

October: Discipline & Earning Power

(Build consistency and push for systems growth)

Supplement: A woman-in-business biography (The Spanx Story, Becoming, Lean In)

Experiment: Practise one high-leverage skill for 20 minutes daily (writing, speaking into camera, vlogging)

Project: Work in a co-working space or library on your side hustle

November: Wealth & Expansion

(Learn how money grows and how to think bigger)

Read: The Psychology of Money and Girls That Invest

Watch: Casey Brown’s TED Talk, Know your worth, then ask for it

Experiment: Run an investing simulation with 3 ETFs or stocks

Project: Have a money date and map your 2026 goals with a friend

📌 Save the IG post here for future reference:

Weekly Structure (The Backbone)

Here is a structure to help you implement this immediately. It’s totally doable if you swap out scrolling and any other ‘dead’ time you might have in the day.

This includes physical habits to keep your mind and body in tip top shape: because a healthy body supports a healthy mind, and vice versa. Physical activity also helps with retention and memory.

Day

Activity

Monday - Thursday

Read 20-30 pages (~25-40 mins)

Friday

Active recall (summarise notes, 3 bullet takeaways)

(15-20 mins)

Saturday

Experiment (apply what you’ve read)

Last Saturday of the month

Final project (1–2 hrs max)

Sunday

Reflection (journal: “What did I learn? How does this apply to my money/life?”)

Daily

Walk without stimulus (no podcasts, audiobooks etc - allow your brain to process)

Monday, Wednesday, Friday (or 3x a week)

Strength training/Pilates

The Challenge

Most people never finish things… they start with motivation and end with guilt or shame.

This 12-week curriculum is about finishing. Proving to yourself that you can stay disciplined, finish the books, and build the skills you talk about.

By December, the goal is simple:

Smarter

Stronger money habits

Higher earning power

More confidence

And that’s how you end 2025 financially, mentally, and physically hot. Start now and build your portfolio of proof.

How did you find this issue?

Share Financial Hot Girl

✧ Grow the financial hottie gang ✧

{{rp_personalized_text}}

Or copy and paste this link to others: {{rp_refer_url_no_params}}

✧ Simplest way to get referrals quickly? Share a screenshot of Financial Hot Girl on your instagram story with your unique referral link. Thank you for your support 🫶

This newsletter and everything shared in it is to help you build a well-rounded, aspirational life that includes money. I hope it was able to do that today 🫶

— Dev xo