Your ultimate Financial Hot Girl A/W menu 🍽️

Plus, a reader dilemma on what to do with extra cash

Happy Monday FHGs,

ICYMI, we were on the UK’s BBC Radio 1 last week (peep 30 mins in)! What a surreal moment for financial hot girls. Our way of life is catching wind!!

However, Autumn/Winter (or Fall 👀..) is in full swing and I’ve had my electric blanket on most evenings already. And to be honest, with the change in season I always find myself wanting to refresh my routine.

A refresh that involves finances and habits that make me feel great not only throughout these colder months, but also gets me prepped for going into a new year.

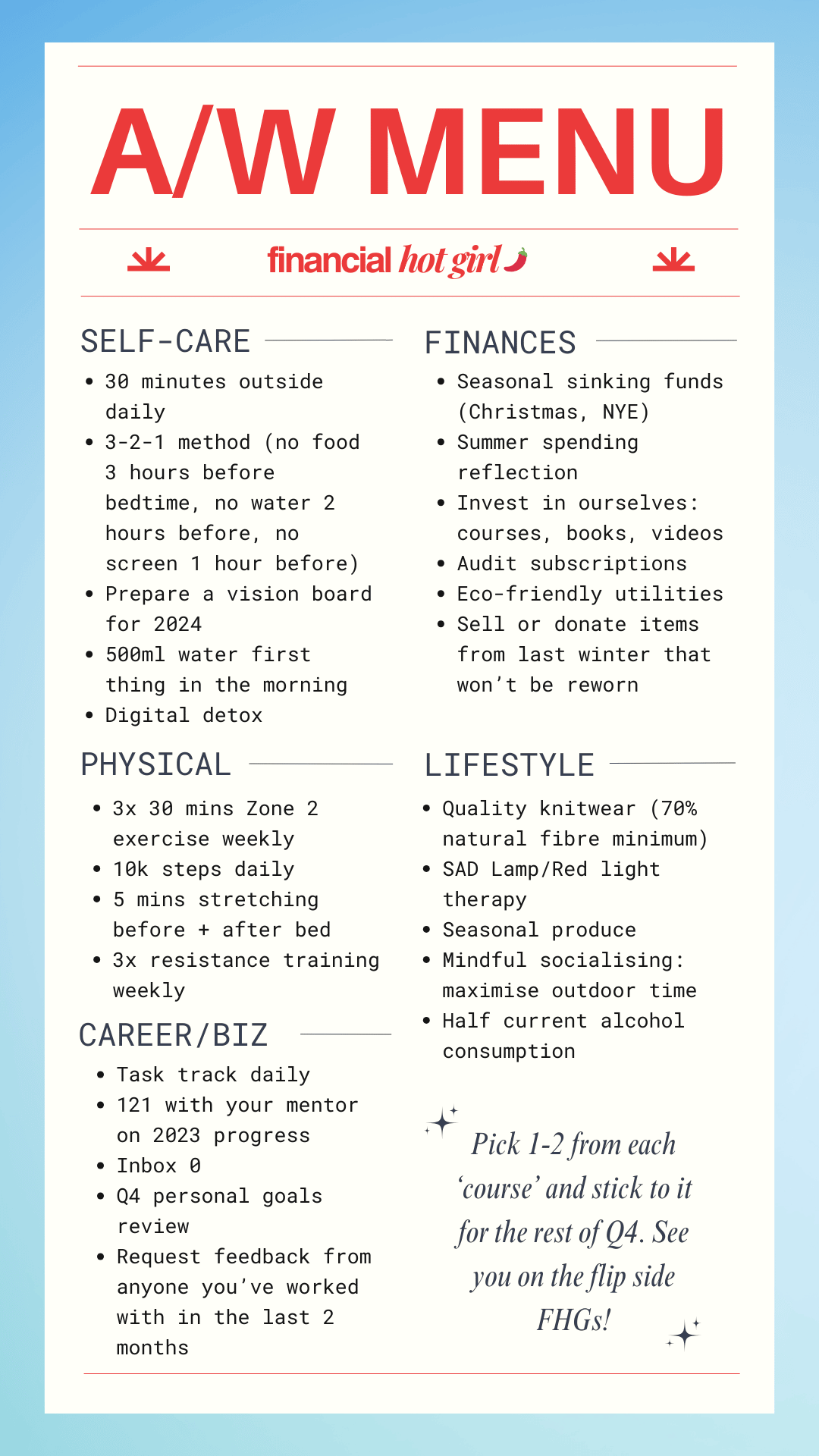

So here’s a menu of habits, traits and routines that are going to build your bank account, increase your mood and keep you looking and feeling your best self.

Call it a build-your-own-personalised-roadmap for a financially and emotionally healthy season.

Hi and thank you in advance for any help!

Me and my partner are currently saving for our first house and also our future wedding (we want to delay getting engaged until we know we can get married fairly soon after).

He lives with his family & I am renting. I think we’ve saved about half of what we need and hoping in 12 months we would have reached our goal.

Currently our money is in H2B ISAs (this will be maxed out in 4 months) and bank accounts (roughly 4% interest in Chase).

I invest £100 p/m in S&P500 (mainly to keep in LT with the aim of increasing my amount as my salary increases) but I was wanting advice to see if there are better places to put my money that is fairly secure and I’ll be able to access in about a years time?

Just advice to see what would you do if you were in this situation (I know everyone’s situation is different and I would say I’m very financially anxious about where to put my money)?

I’m super anxious about where money goes, too! It can be SO worrying to think all your hard earned savings could be at risk if you don’t research a decision thoroughly. My personality type demands a month worth of research before making any kind of decision. It’s kinda debilitating 😆

If I were in your situation, 1 year means short term. I’d research high-interest savings accounts and pick the one which has terms that suit my situation—e.g. a lot of accounts have a 3-24 month withdrawal restriction so you may have to pick between these, while maxing out the ISA still. This is usually my first point of call when researching.

I would also ensure my current account is one offering the best rate, just so that all of my cash savings are in their most efficient position until you hit that goal.

I love that you have prioritised long-term investing and effectively your future too, even though you know you have some lovely big goals coming up. Massive kudos on being 12 months away from two huge goals and good luck on that road to completion!!! 🎖️

Get involved with the community AMA and submit an anonymous dilemma 💌

This week in hot girl resources: you sent me this podcast episode on hacking your influence and charisma to increase your earning potential. This was SO interesting, I put it on during a shower. Watch out for a TikTok video coming on the things I learnt... comment with a 🚿 if you see the video!!