you're too cool to not be financially literate

being hot is knowing how money works: a practical breakdown of the skills that actually compound your life | fhg #74

Happy New Year financial hotties 🫶 I hope this year brings you your biggest, juiciest goals.

There’s a lot of noise right now on how to be cool/chic/smart, and you probably already are—but in my opinion, none of it truly matters if you don’t have a foundation of financial literacy.

I know this because growing up, I was the [very] uncool Asian girl with oily hair and a smelly lunch. And when I forced a glow-up in my teens and found a version of coolness in my early twenties, it still didn’t help, because I didn’t understand money.

Without financial literacy, cool girl traits like drive and ambition turn inward. They get spent on stress, comparison and overthinking instead of compounding your life.

Last week, we talked about choosing a financial identity for 2026. Identity determines how you act when no one is watching, when plans change, when money feels tight, or when you feel behind.

This week is about the natural next step: specific skills for financial literacy. But what does that actually involve?

This issue is free because it’s foundational. It’s also a good example of the depth and structure paid subscribers get inside Financial Hot Girl. I don’t share ideas without showing you how to work with them. Information is only useful when it changes behaviour.

During January, I’m running a launch offer to lock in 33% off for life. Join now to get a head start on becoming Financially Hot as I migrate all the paid resources over to Substack!

Financial literacy as a skill stack

No one is born good or bad with money. You pick up beliefs as you grow up, often without realising it. Those beliefs quietly shape how you think, feel, and act financially.

I grew up in an immigrant household with a strong scarcity mindset. Wherever you’re starting from, there’s nothing to be ashamed of. We just name it so we can change it.

For me, that looked like beliefs such as:

When money comes, hold onto it before it goes

…or spend all of it because it may never come back

Stability = wealth

Risk = instability = no wealth

Time/fun/rest is a luxury for people with money

Hard work = money

etc…

Financial literacy, at its core, is the process of noticing those beliefs, questioning them, and replacing them with better mental models. Models that help you make calmer decisions over time.

None of them are specific to people born in ‘better’ conditions. These are skills, like cooking, painting or dancing, that you build over time.

7 skills of financial literacy

Skill #1: Understand cashflow

My biggest financial wins in my early 20s came from understanding the major benefit of treating myself like a business. Every business has a universal structure:

Income

Expenses

Assets

Liabilities

Resulting profit/loss

If a business has too many expenses and not enough income, it makes a loss. We are the same. Our spending must be influenced only by our income, but up to a point.

Early on in a financial literacy journey, understanding how to live within your means (spend less than you earn) is vital. Once you have mastered this, it’s more inefficient to be unnecessarily frugal—and more efficient to think about increasing and reinvesting your income.

How to do it: spend 1-3 months tracking your transactions. Read: don’t budget yet. Track every transaction and review it once a week. The behaviour you’re building is checking in with your money without judgement. When awareness becomes neuttral, better decisions follow naturally.

Resources: I Will Teach You To Be Rich, chapters 1-3. Even when the topic is credit or investing, the underlying lesson is cashflow control and automation.

Skill #2: Saving effectively

Having a locked-in sinking fund strategy transformed my finances in the earlier days.

A sinking fund is a strategic financial tool where money is set aside over time to cover a specific, planned future expense or to repay a long-term debt.

This was a skill because it required two sub-skills:

Delayed gratification

Discipline

One of my first real sinking funds was for a friend’s hen do in Dubai. I was invited around 9 months in advance. I asked for a rough budget, added a ten percent buffer, and landed on £2,200.

Once flights were booked, I needed to save £244 a month. I set up a savings pot, automated the transfer for payday, and left it alone. By the time the trip arrived, I had £2,000 ready with a buffer.

At the time, I was earning around £2,000 a month, so that meant over 10% of my income was pre-allocated to just one future expense. So every single decision I made had to respect that. It forced commitment.

This is what effective saving looks like. It allows you to pre-decide your spending and fund future versions of yourself without stress.

How to do it: stop asking “can I afford this?” and start asking “how much do I need to set aside each month?”. Identify upcoming expenses over the next 6–12 months, then automate contributions on payday. The behavioural shift here is pre-commitment. You Decide Once™, early, and remove the need for willpower later.

Resources: My Sinking Funds Video, The Financial Diet, content on irregular spending or planning for things you actually want.

Skill #3: Investing

The most essential thing to understand about money is that it loses value over time. Which is why skill #2 has a ceiling and a specific use, only for emergencies and short term goals—because saving all of your money is pointless hard work. It loses value over time because of inflation:

£100 of X now will be worth £80 of X in 10 years (not exact figures, just a description)

This is called the time value of money, and it decreases because of inflation—things increasing in price over time

It’s not all doom and gloom though, as there’s a way to protect yourself against this loss—through investing that money elsewhere, like in an index fund.

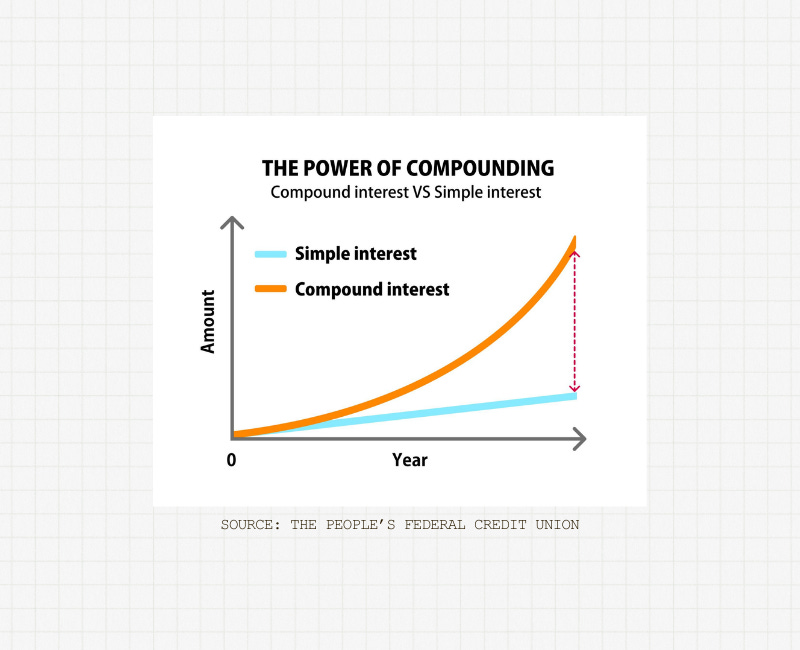

However, investing as a skill to learn is not about picking stocks or strategising a portfolio. It’s more about understanding why investing exists at all: compound interest.

Compound growth is simply money earning money, repeatedly, over time.

This skill is about learning:

how compounding works in practice

why consistency beats timing

how risk decreases with time

why starting matters more than starting with “enough”

How to do it: shift your behaviour from hoarding (saving) to participating. Learn about index funds (or another asset) deeply, and commit to consistency. The key behaviour is starting before you feel ready and staying invested through boredom.

Resources: The Psychology of Money, chapters 4-7. The Simple Path to Wealth, chapters 1, 4, 6 and 8. Friends That Invest, the whole damn book.

Skill #4: Taxes and optimisation

Understanding tax means knowing why your payslip looks the way it does, why side income feels disappointing at first, and how allowances actually work. It stacks onto skill #2, by being able to save effectively using high-interest accounts.

This skill is about:

understanding gross versus net

knowing marginal tax rates

using pensions, ISAs, Roth IRAs and other tax-efficient accounts properly

avoiding avoidable mistakes

When you understand tax, earning more stops feeling confusing. You know what to expect. That alone removes a lot of frustration, especially as earning more is a big goal for a lot of us.

How to do it: spend time understanding how tax applies to you specifically so earning more stops feeling emotionally charged. The behaviour change is moving from avoidance to anticipation. You plan with tax in mind instead of feeling disappointed after the fact.

Resources: Nicole - The London Accountant, Bola Sol, Vivian Tu, How To Own The World, chapters 2, 6 and 7.

Skill #5: Debt (and credit cards)

Debt is not moral. We need to let go of any and all shame attached to it, because it’s mathematical. In the financial world, there is favourable and unfavourable debt.

When I had credit card debt in my twenties, I didn’t fully understand interest, minimum payments, or how long debt actually takes to clear. All I knew was that I felt anxious and incredibly ashamed of my unfavourable debt.

But when I learned about favourable debt—the kind that wealthy people use to multiply their wealth, I started to understand that debt is a tool. And like any tool, it can either build or destroy depending on how it’s used.

Financial literacy here is learning to separate destructive debt from productive leverage.

This skill is about understanding:

what interest is

why minimum payments keep you trapped

how time and interest work against you in bad debt

how time and interest can work for you in good debt

why wealthy people are often comfortable using leverage

Unfavourable debt usually funds consumption you can’t afford, while favourable debt is typically attached to something that grows, produces income, or increases long-term capacity.

How to do it: list all current debts with balance, interest rate, and purpose. Learn how much interest each one costs you monthly. Then learn how leverage works in practice, mortgages, business investment, education, assets. The goal is not to take on debt, but to understand when debt accelerates progress instead of slowing it down.

Resources: The Psychology of Money, chapters 8, 9 and 14.

Skill #6: Decision-making

This is the skill that turns knowledge into confidence, which is Financially Hot®.

Most people know what to do in theory, but they struggle with choosing when trade-offs exist.

“Should I save or travel?”

“Pay this off or invest?”

“Stay in a stable job or take a risk?”

Financial literacy here looks like understanding opportunity cost and choosing deliberately.

How to do it: when facing a decision, write down what you gain, what you give up, and what version of you this choice supports. There is rarely a single correct answer. Confidence comes from choosing for intention instead of optimisation—a trap a lot of us ambitious women fall into.

Resources: Thinking In Bets, chapters 2, 4, and 6. The Almanack of Naval Ravikant, sections on wealth, leverage, judgement and long-term games. If you choose only one, read or listen to Naval. This video also changed my life (and understanding of leverage in the context of decision-making).

Skill #7: Systems and automation

Do you think that if I left it up to me and manual effort, I would have aggressively invested my income for 3 years? Probably not. As a financially literate person, I did not rely on discipline. I created a system and absolutely did not rely on effort.

This looks like:

automated saving and investing

fixed review routines

simple rules revisited occasionally

fewer daily money decisions

This is why financially literate people are not stressed by money, despite being factually more aware and ‘obsessed’ with money. They are less involved in the day-to-day.

How to do it: design money to work without daily effort. Automate saving, investing, any bills, then step back. The behaviour shift is trusting and forgetting the systems over white-knuckling a sense of discipline. You reduce how often you interact with money, so decisions stop draining your energy.

Resources: Atomic Habits, chapters 1, 2, 4 and 6.

This would have been a paid post, but I made it free because information should not be gate-kept—I learned all of this largely for free in my 20s, aside from buying multiple books.

What usually is paid is the part people underestimate: structure, sequencing and the discipline of implementation. The thinking required to turn information into behaviour. If this sounds like you, upgrade your subscription to lock in the launch offer ⤵

So if you’ve chosen the identity of becoming financially literate this year, these are the skills you’re committing to practising consistently. The question now isn’t what you know, it’s how you’re going to work with it.

Until next week,

—Dev xo

I love this. Thank you for sharing and making it accessible for everyone ❤️

Thank you for the thorough breakdown along with resources! I'll definitely be checking out! I appreciate that you broke everything down into bite-sized skills, and that you pointed out "debt isn't moral". We shouldn't feel shame for getting in debt because there are many reasons a person ends up in debt. There's no shame in that.