you're too smart to not be obsessed with money

6 things financially smart women do differently | fhg #80

Happy Sunday financial hotties! After a week by the Salvadorian coast, you know what’s been on my mind? My why. Why do I want to blow past an average income goal? Why did I quit corporate after chasing it for so long? Why does money matter to me in a way that feels almost obsessive?

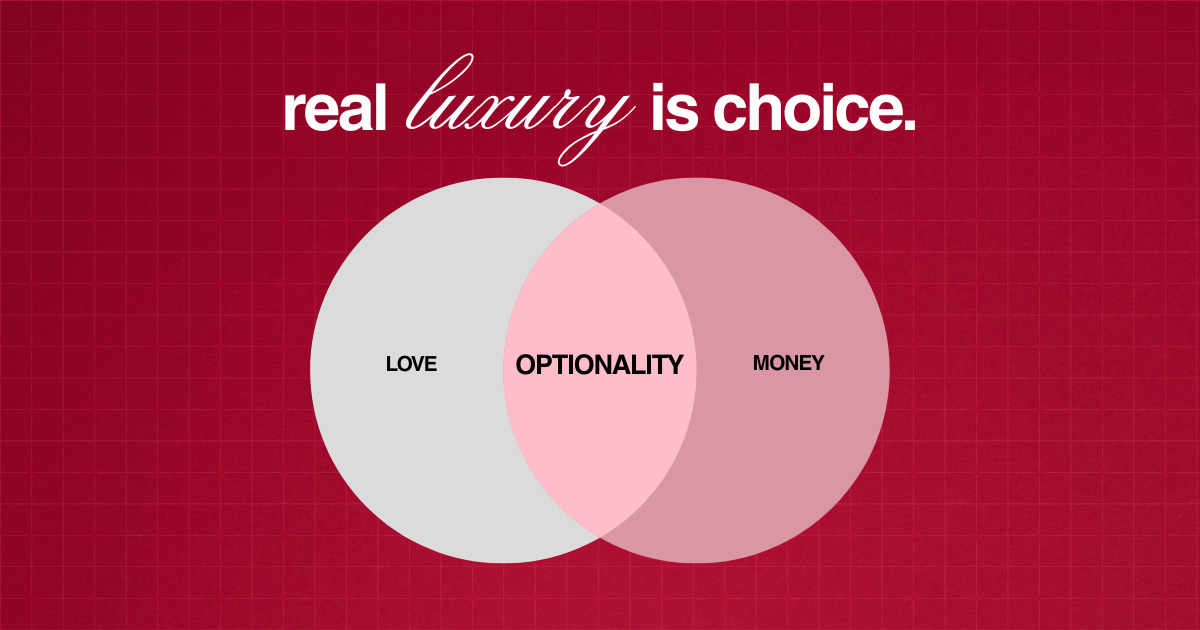

So while on the beach, I spent some time trying to critically challenge1 my why. And it revealed what pains me the most— to see, experience or be a woman who does not have optionality when it comes to being in relationships. A woman who stays because she has to, or shrinks because leaving would destabilise her, or who tolerates disrespect because rent is shared. That fear (more than a desire for luxury or status, for me) is what sits underneath my ambition.

It’s the reason a lot of us are—or should be—obsessed with money. Utterly and completely obsessed with acquiring and investing as much of it as possible. Money, used properly, buys leverage. It buys the ability to leave and choose yourself in any situation. Handbags and apartments are just the cherry on the cake. The real luxury is choice.

So today, we’re talking about the six financial behaviours ambitious women adopt when they are serious about building a life with options, because you’re simply too smart to not be obsessed with the money that buys them.

Keep emergency funds private

An important distinction I want to make is here is privacy versus secrecy. Financially free women have money that is accessible to them, and them only. It is not mixed into a joint account, or dependent on someone else’s signatory (and definitely not a ‘we’ll figure it out together’ fund).

Liquidity is important in any circumstance, because it gives you power. If you can fund your own exit from a relationship or a job, you can negotiate any situation with confidence. You’ll probably tolerate less and make excuses less. You will certainly not feel trapped by logistics.

Maintain a financial identity

In Mexico, we met a couple celebrating their 50th anniversary. I asked them to share their best bit of relationship advice and they told me: “In any situation, you’re both in the boat together. It’s always ‘we’, never just ‘I’. It’s both your responsibilities to not sink the boat.”

It’s great advice, and I hold it close. But financially, for ambitious women, and as an ambitious woman myself, I do not dissolve into “we”. Even in a loving, stable relationship, certain things must be done in your own name:

Having accounts

Building credit

Understand every asset and liability

Know exactly what comes in and goes out

In relationships, dependence always starts subtly. Someone else handles a bill once or ‘sorts the investments’. It feels convenient at the time, especially if you’re busy and overwhelmed, but easily turns into vulnerability 10 years down the line.

Maintaining your own financial identity isn’t the same thing as doing it all yourself (and trapping yourself in masculine energy), it’s making sure you have an awareness over everything at the very minimum—that there is transparency over shared assets and liabilities.

Protect your earning potential relentlessly

One of our biggest owned financial assets as women is our ability to earn. Once this declines, whether through motherhood, caring responsibilities, burnout, etc—rebuilding is incredibly hard.

Staying aware of changes in the market, building skills that stabilise or increase your market value, keeping your network warm, maintaining any and all professional certifications and ensuring that your income is growing (or can grow) faster than inflation are key priorities when treating your career like an assets instead of simply ‘a job’.

Separate stability from safety

On a reality TV show called Selling Sunset, one of the realtors Chelsea Lazkani recently went through a public divorce. On one of the episodes, when ‘accused’ of having a generous spousal support payment, Lazkani admitted that her finances post-divorce were so tight that she now has a newfound appreciation for single mums. It’s a great example of the difference between stability and safety:

Stability = things that stay the same and are predictable. Think: shared rent, living costs or shared routines. What Lazkani had pre-divorce.

Safety = a sense of stability, but without routine. Leaving a situation in 30-60 days without financial panic or not going into debt to meet basic living costs. What Lazkani probably had to build, and keep building post divorce.2

Ambitious women should be asking themselves—despite their current stability, if their relationship ended tomorrow, would they be ok?

Understand unromantic, unsexy legal and financial structures

A lot of women in my life cohabitate with their partners. In the UK, it’s sometimes referred to as ‘a live-in partner’ or an ‘unmarried partner’. Did you know that there are things that cohabitation does and doesn’t protect?

Outside of that, there are also other structures to understand:

Whose name is on what (accounts, bills, insurance)

What joint ownership actually means

What marriage legally changes

What breaking-up or divorcing actually costs

Whilst romance is emotional and fun and cute, the legal structures that uphold it—like marriage and cohabitation—can severely impact our finances and honestly, are really easy to ignore. But not understanding them is a future financial liability that you’re signing up for.

Build a life you could afford alone

The least romantic yet most adult thing to do in life is to avoid building a life that 100% relies on two incomes, without over-indexing on hyper-independence.

Importantly though, not building a life that only works if someone else stays ≠ planning for a break-up. Nobody has a guarantee over how life will pan out. There is no genie with all the answers or your future written definitively in stars. Building a life you can afford alone is simply the smartest thing to do in a world that disadvantages women.

Before moving in with someone, before upgrading your life, before merging assets or co-signing anything, ask yourself:

If I had to afford this alone, could I, and would I actually want to?

Don’t get me wrong, building a bigger life together can be powerful. Two aligned incomes can materially impact how fast you build wealth, and a strategic partnership can be life changing.

The key difference here is ensuring your baseline survival costs are costs you can afford. I’m not encouraging you to try and afford everything alone, but to instead think strategically about how you inflate your costs with a partner in a way that traps you into needing them financially. The goal is to want to stay in a relationship, not to need to stay.

There is something very powerful in being a woman who understands both the emotions and the economics of a relationship, so be one. Be obsessed with money. You’re too smart not to be.

— Dev xo

Thanks to the incredible Shae O. Omonijo for creating this super cool tool, which encourages you to think critically in the age of AI. Use it!

I am purely speculating and making assumptions, I have no idea what is going on with the finances of the Selling Sunset cast. This situation is being used as an example.

This was very realistic and practical especially in the aspect where you stated in knowing the difference in the emotions of being in a relationship, wanting to be in a relationship and being able to walk away when you have to. I do feel that as much as you state “Two aligned incomes can materially impact how fast you build wealth, and a strategic partnership can be life changing.” It’s still definitely always easier to manage and make decisions when you’re only managing your finances.

I like so much of this advice, besides the use of the word "obsessed." I do truly think that we all need to be financially educated, but I'd much rather be obsessed with the freedom and stability that money can provide us versus the money itself!